Relative Momentum Trading Strategy: SPY vs GLD

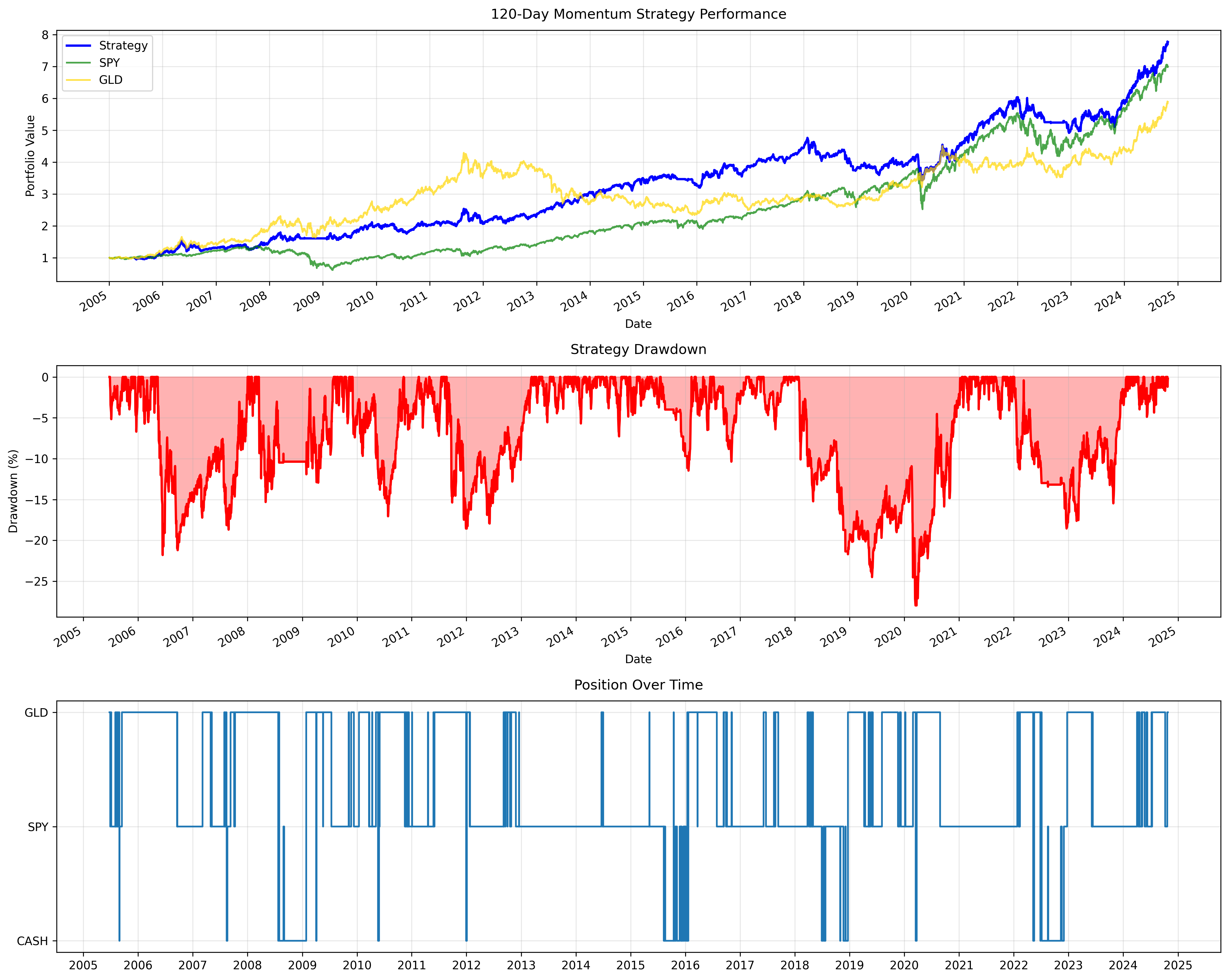

In this post, we’ll explore a momentum-based trading strategy that dynamically selects between SPY and GLD based on relative momentum, moving to cash during adverse market conditions to manage risk effectively. It aims to balance growth potential from equity (SPY) with a defensive position in gold (GLD), providing flexibility in various market conditions. Strategy Overview … Read more